Unlock Your Path to the Perfect Solution

Easy FUNDING

Unlock Real Estate Success with Speed and Ease. As an investor or wholesaler, experience the freedom of swift deal funding without the stress of credit checks.

We've got your Earnest Money Deposits (EMD), double closings, and even down payments on seller carry-backs covered.

Partner with us for seamless financial support that keeps pace with your ambition.

Act now propel your property portfolio forward today!

EMD Funding: We offer a flat 10% upfront return on all EMD deals, funding up to $100k. Deals over 30 days incur an extra fee. The 10% fee is non‑refundable, with a $1,500 minimum.

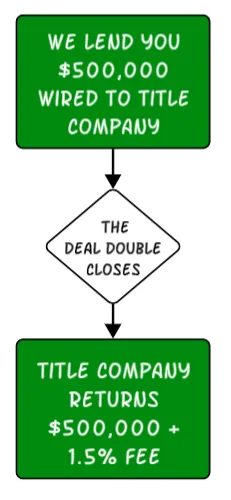

Double Close Funding: We charge a flat 1.5% fee for all double closings with at least one week’s notice. Faster funding requests require review. Minimum return: $1,500.

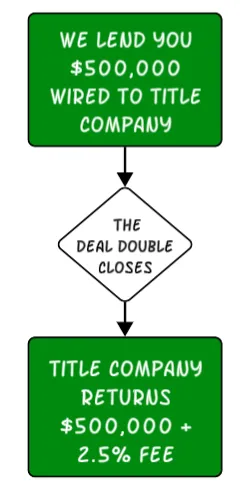

Morby Method Funding: We charge a flat 2.5% fee on seller carry‑back deals with at least one week’s notice. Faster funding requests require review. Minimum return: $1,500.

EMD Funding

Example

Double Close Funding

Example

Morby Method Funding

Example

Frequently Asked Questions

How much do you charge per transaction?

We charge 10% up-front return for EMD (up to 30 days) and 1.5% for double close funding up to $1M to start. These numbers can change depending on duration of the deal and risks involved. Seller carry-back funding starts at 2.5% for the added work.

Are there any up-front fees?

For EMD, we charge the entire fee up front to pay our team for underwriting and processing the deal. Sadly we must do this so we don't end up losing money by funding your cancelled deal. This is significantly lower than what most people charge when a deal closes, so if you're confident in your deal you'll save lots of capital.

What qualifies as double closing?

A double closing is a real estate transaction method where two back-to-back property sales occur on the same day, involving three parties: the original seller, the wholesaler (middleman), and the end buyer.

Here's how it works:

First Transaction: The investor agrees to purchase the property from the original seller.

Second Transaction: The investor simultaneously sells the property to the end buyer at a higher price.

During a double closing, the investor typically uses the funds from the end buyer to complete the purchase from the original seller. This allows the investor to profit from the difference in sale prices without needing to use their own funds for an extended period. Double closings are often used in real estate wholesaling and transactional funding, allowing investors to efficiently facilitate deals and earn profits by connecting motivated sellers with interested buyers.

What qualifies as the Morby Method?

A stack method deal otherwise known as a seller carry-back occurs when the buyer gets a new loan to purchase the property, and then comes to an agreement with the seller for them to finance the down-payment behind the loan.

If your deal matches this structure, we will fund the down-payment for the first transaction until it is replaced with the money the seller is willing to finance to you after the purchase as agreed.

Can you fund EMD for end buyers?

We can fund EMD for end buyers if you and the seller sign an addendum making the inspection period go through the close of escrow. All details will be sent when your deal is submitted.

Is there a max amount you can fund?

We will fund up to $100k on EMD and $100M for double closings. As long as your deal qualifies under our standards, we will be your one stop shop for all transactional funding both now and in the future!

How quickly can we get our deal funded?

We typically require 48 hours of notice to fund a deal, however we have funded in as quickly as 5 minutes (seriously). If you have a deal, your best bet is to submit it as soon as possible so we can review it and get the process started.

What happens if the deal doesn't close?

If an EMD deal does not close, we just have the EMD sent back. Your only cost would be the up front fee and nothing else.

For double closing and seller carry-backs there would be no charge since we don't fund until closing.

Testimonials

From start to finish, the process was seamless. The team provided clear guidance, answered all my questions, and helped me secure a fantastic rate. I felt confident and supported every step of the way!

— Mark T.

Working with the team made the process so easy! Their transparent approach and personalized options were exactly what I needed. The entire experience was stress-free.

— Sarah J.

Harnessing Technology for Seamless Real Estate Funding

Harnessing Technology for Seamless Real Estate Funding

Forget the old wait-and-worry routine that slows your deals down. Real estate funding doesn’t have to drain your time or patience. MyInvestor.Loans uses technology in real estate to deliver seamless funding solutions that get your deals moving fast. Stick around to see how quick real estate loans can become your new secret weapon. For more insights on streamlining processes with technology, check out this article.

Streamlining Real Estate Funding

Navigating the funding maze can be daunting. But what if you could cut through the red tape? Real estate funding with MyInvestor.Loans offers a straightforward path to quick approvals and reduced paperwork. Let's explore how you can speed things up and minimize hassles.

Speeding Up Loan Approvals

Time is money in real estate. Every day counts when you're chasing a hot deal. MyInvestor.Loans knows this, which is why quick real estate loans are a priority. You can expect approvals faster than traditional lenders, letting you jump on opportunities without delay.

Step 1: Submit your application online. No need for lengthy in-person meetings.

Step 2: Get a decision typically within 24 hours. No more waiting weeks for an answer.

Step 3: Receive your funds swiftly, ready to be deployed where needed.

Most lenders drown you in paperwork. Not here. MyInvestor.Loans simplifies the process, offering a streamlined approval that gets you from application to funding without the usual hurdles.

Reducing Documentation Hassles

Are you tired of endless forms? You're not alone. Many investors find traditional loan processes cumbersome. MyInvestor.Loans cuts through the clutter, reducing the paperwork needed to get your funding.

Minimal documents required, making your life easier.

No credit checks mean fewer hoops to jump through.

Clear guidelines help you know what's needed upfront.

Imagine the relief of fewer forms and less paperwork. You spend less time on admin and more time on what matters—securing your next property.

Technology's Role in Real Estate

Technology is reshaping real estate investment. It offers tools that speed up processes and deliver vital insights. Here's how technology in real estate can be your game-changer, providing tools for faster, smarter funding.

Digital Platforms for Funding

Digital platforms are at the forefront of this transformation. They bring the entire funding process online, making it accessible and efficient. MyInvestor.Loans leverages such platforms to provide seamless funding solutions.

Online applications mean you can start the process anytime, anywhere.

Real-time tracking keeps you updated on your application's progress.

No more trips to the bank or waiting in line. Everything you need is just a few clicks away. Digital platforms save time, letting you focus on growing your investment portfolio.

Real-Time Data Insights

Access to real-time data is another technology perk. It helps you make informed decisions quickly. MyInvestor.Loans uses this data to evaluate deals swiftly and offer competitive terms.

Market trends are analyzed to give you the best options.

Immediate feedback on your loan status keeps you in the loop.

This is more than just convenience; it's a strategic advantage. Real-time insights help you stay ahead, adjusting your strategies based on up-to-date information.

MyInvestor.Loans Advantages

Choosing MyInvestor.Loans means opting for speed and simplicity. Our approach to real estate funding eliminates unnecessary hurdles, providing you with quick, reliable solutions. Let's dive into what makes our loans stand out.

Quick Real Estate Loans Explained

Need funds fast? MyInvestor.Loans specializes in delivering quick real estate loans without the usual wait. Here's how:

Fast processing: Your application moves fast, often within 24 hours.

No credit checks: This means fewer delays, getting you funds faster.

Clear, flat fees: Know what you're paying—no surprises.

This efficiency is crucial in competitive markets, where opportunities can disappear overnight. With MyInvestor.Loans, you have a reliable partner that keeps pace with your ambitions.

Personalized Funding Solutions

One size does not fit all. Every deal is different, and so are your funding needs. MyInvestor.Loans offers personalized solutions tailored to your specific situation.

Custom funding options for earnest money deposits, double closings, and down payments.

Expert advice to help you choose the best solution for your needs.

Our goal is to support your unique investment journey, providing the financial tools necessary to succeed. With personalized funding, you can focus on what you do best—investing in real estate.

The longer you wait, the more opportunities you might miss. Consider how MyInvestor.Loans can streamline your real estate funding today, ensuring you're always ready to seize the next great deal.

Get In Touch

Phone